Don't miss our holiday offer - up to 50% OFF!

How to Use the Jupiter App: A Complete Guide

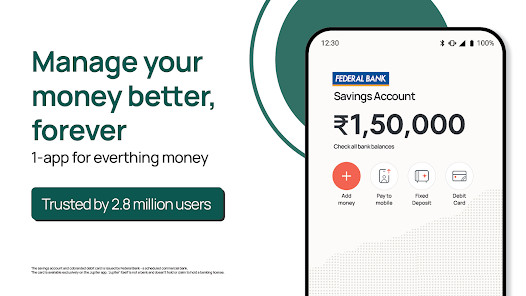

In today’s fast-paced world, managing personal finances efficiently is more important than ever. With the rise of mobile apps designed to simplify financial management, the Jupiter app stands out as one of the most user-friendly and comprehensive tools for budgeting, saving, and investing. Jupiter provides an intuitive and modern interface that empowers users to take control of their finances and make smarter financial decisions. Whether you’re looking to save money, track your spending, or learn about investing, the Jupiter app has something to offer.

This article will explore the steps on how to use the Jupiter app, breaking down its key features and functionalities. We’ll walk you through setting up your account, utilizing the app’s tools, and maximizing its capabilities to improve your financial health. With this guide, you will be ready to make the most out of the Jupiter app and take charge of your financial journey.

Step 1: Download and Set Up the Jupiter App

Getting Started with Jupiter

The first step in using the Jupiter app is to download it from your device’s app store. The app is available for both iOS and Android devices, so you can easily find it in the Apple App Store or Google Play Store. Once downloaded, the app will prompt you to create an account. You’ll need to provide some basic information, such as your name, email address, phone number, and date of birth.

Creating Your Account

- Email Address and Phone Number: Enter your email address and phone number to receive notifications and account updates.

- Password: Create a strong and secure password for your account. This will ensure the safety of your financial data.

- KYC (Know Your Customer) Process: To comply with regulatory requirements, you may be asked to verify your identity. This typically involves providing a government-issued ID and a selfie for identity verification.

After completing these steps, you’ll have full access to your Jupiter account and be ready to explore the app’s features.

Step 2: Link Your Bank Accounts and Cards

Integrating Your Financial Accounts

One of the key features of Jupiter is its ability to link and integrate with your existing bank accounts and credit/debit cards. This allows you to manage all of your finances in one place and track your spending across various accounts.

- Linking Bank Accounts: Jupiter supports integrations with most major banks. You’ll need to enter your bank account details, such as your account number and routing number, or use your bank’s login credentials to link the account.

- Adding Cards: To link credit or debit cards, simply enter your card information or link your digital wallet to the app.

Once your accounts are linked, Jupiter will automatically start pulling transaction data, which will help you gain insights into your spending patterns.

Also, Read Why am I following JD Vance on Instagram: Why it matters

Step 3: Explore Jupiter’s Budgeting Tools

Setting Up Your Budget

Jupiter offers a range of budgeting tools designed to help you track your expenses and achieve your financial goals. The app automatically categorizes your spending into different categories, such as groceries, transportation, entertainment, and dining out. You can adjust these categories based on your preferences, and set monthly or weekly budget limits for each.

- Budget Categories: Jupiter’s smart categorization will break down your spending in a way that is easy to understand. You’ll see how much you’ve spent in each category, which can help you identify areas where you might be overspending.

- Setting Limits: Once the categories are set, you can set spending limits for each one. For example, if you want to limit your entertainment spending to $100 a month, Jupiter will alert you when you’re approaching this limit.

- Tracking Your Progress: The app provides real-time updates, showing you how close you are to your budget goals and offering helpful tips for staying within your limits.

Jupiter’s budgeting tools are designed to give you a clear overview of your spending habits and help you stay on track with your financial goals.

Step 4: Use Jupiter’s Saving Tools

Automated Savings Goals

In addition to budgeting, Jupiter also provides tools for saving money. You can set up savings goals for various purposes, such as an emergency fund, vacation, or large purchases. Jupiter makes it easy to automate savings by setting up recurring deposits into your savings goals.

- Create Savings Goals: Choose the purpose for your savings (e.g., emergency fund, vacation, or rainy day fund), and the app will help you break down how much you need to save each month.

- Automated Transfers: Set up automated transfers to move money from your linked bank account or cards into your savings goals. You can choose whether you want the transfer to happen weekly, bi-weekly, or monthly.

- Tracking Savings Progress: Jupiter provides progress bars for each goal, so you can visually track how close you are to reaching your target.

This feature makes it easy to save consistently without thinking about it, allowing you to build wealth over time with minimal effort.

Also, Read Instagram Launches ‘Edits’: A New Video Editing App Amid TikTok Ban

Step 5: Learn About Investment Options

Exploring Investment Opportunities

Jupiter offers users the opportunity to invest their money in various financial products. While budgeting and saving are essential components of financial health, investing is crucial for building wealth in the long term. Jupiter provides a range of investment options, including mutual funds, ETFs (exchange-traded funds), and stocks, making it easy for users to start their investment journey.

- Investment Education: For beginners, Jupiter offers educational content that explains the basics of investing, risk management, and diversification. You can explore articles and videos that provide clear explanations of different investment strategies.

- Automated Investments: Jupiter also offers automated investing features, where you can set up recurring contributions to your chosen investment products. The app uses algorithms to invest your money in a diversified portfolio based on your risk profile.

- Tracking Investments: You can monitor your investment portfolio directly from the app, viewing its performance over time, and adjusting your contributions as needed.

Investing through Jupiter is a great way to start building wealth for the future, especially for those who are new to the world of investing.

Step 6: Use Jupiter’s Financial Insights and Reports

Analyzing Your Financial Health

Jupiter provides comprehensive insights and detailed reports to help you better understand your financial situation. You’ll receive monthly summaries of your income, expenses, savings, and investments. These reports break down your financial habits and highlight areas where you can improve.

- Financial Health Score: Jupiter offers a financial health score, which gives you an overall snapshot of your financial well-being. This score is based on various factors, including your spending habits, savings, and debt management.

- Spending Trends: The app also identifies trends in your spending, such as whether you’re overspending in certain categories or consistently meeting your savings goals. This helps you make informed decisions about your finances.

By regularly reviewing your financial reports, you can make adjustments to your budget, savings, and investments to ensure that you stay on track toward achieving your financial goals.

Step 7: Stay On Top of Bills and Payments

Managing Bills and Subscriptions

Jupiter helps you keep track of your bills and subscriptions, so you never miss a payment. You can link your bills to the app and receive reminders when payments are due. This feature is especially useful for managing recurring expenses such as rent, utilities, and subscription services.

- Bill Reminders: Set up bill reminders for your recurring payments, and Jupiter will send you timely notifications before they are due.

- Track Subscriptions: Jupiter allows you to manage and review all of your subscriptions, helping you avoid unwanted charges. If you’re paying for services you no longer use, you can cancel them directly through the app.

This feature makes it easier to stay organized and avoid late fees or missed payments.

Also, Read Understanding Metaverse Stock Prices: A Comprehensive Guide

Conclusion

The Jupiter app is an all-in-one financial tool that can help users take control of their money, make smarter financial decisions, and work toward long-term financial goals. Whether you are looking to budget more effectively, save for the future, invest in the stock market, or stay on top of your bills, Jupiter provides a user-friendly platform that simplifies financial management. By taking advantage of the app’s budgeting, saving, investing, and bill management features, you can gain a better understanding of your financial health and make informed decisions that align with your financial aspirations. With its easy-to-use interface and smart tools, Jupiter is a great option for anyone looking to improve their financial well-being.